L-Sealer Machine Market Trends and Size 2026-35

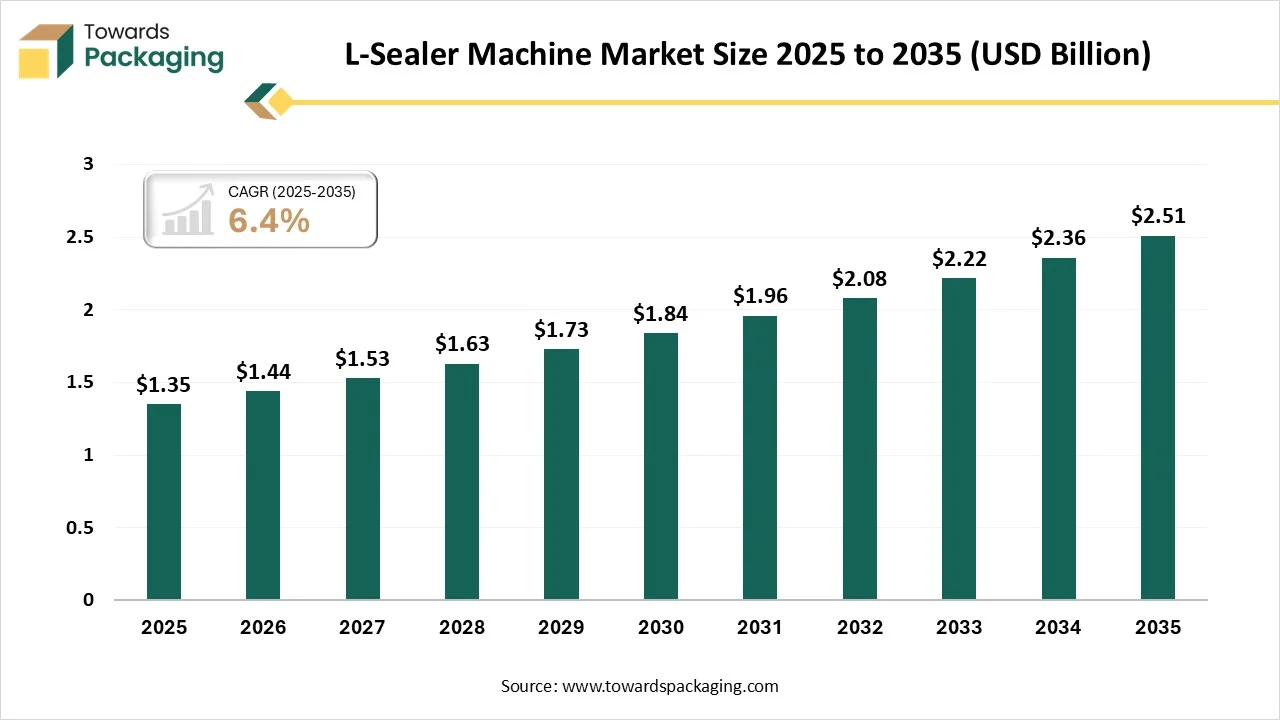

According to researchers from Towards Packaging, the global L-sealer machine market, estimated at USD 1.35 billion in 2025, is forecast to expand to USD 2.51 billion by 2035, growing at a CAGR of 6.4% over the forecast period.

Ottawa, Feb. 10, 2026 (GLOBE NEWSWIRE) -- The global L-sealer machine market reported a value of USD 1.35 billion in 2025, and according to estimates, it will reach USD 2.51 billion by 2035, as outlined in a study from Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is meant by L-Sealer Machine?

An L-sealer machine refers to packaging equipment such as L-type sealers and vacuum packaging systems that create secure seals around products using heat and film or controlled environments. In the packaging industry, these machines wrap, seal, and protect goods across food, consumer goods, and industrial sectors, improving efficiency and product safety. Market growth is driven by increasing automation, demand for efficient protective packaging, and expansion of manufacturing and logistics operations.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5954

Private Industry Investments for L-Sealer Machine:

- Food and Beverage: Companies use L-sealers to package perishable items like bakery goods and produce to maintain freshness and provide a tamper-evident seal.

- Pharmaceuticals: This sector invests in precision sealing to ensure medical devices and medications remain sterile and protected from environmental contaminants.

- E-commerce and Logistics: High-volume fulfillment centers utilize automated sealers to provide dust-proof and durable protection for diverse products during the shipping process.

- Cosmetics and Personal Care: Manufacturers employ these machines to give luxury items like perfumes a professional finish while preventing leaks or unauthorized opening.

- Electronics: Private firms use shrink-wrap L-sealers to shield sensitive components from moisture and static during long-term storage and transport.

- Publishing and Media: Printing houses invest in L-sealers to wrap books, magazines, and stationery in clear film to prevent scuffing and damage on retail shelves.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

What Are the Latest Key Trends in the L-Sealer Machine Market?

-

Rising Automation Adoption

L-sealer machines are increasingly integrated with automated systems to improve packaging speed, accuracy, and consistency. Automation reduces dependency on manual labor, lowers operational errors, and supports high-volume production environments, making these machines attractive for large-scale manufacturing and packaging facilities.

-

Integration of Smart and Digital Technologies

Manufacturers are incorporating sensors, digital controls, and monitoring features into L-sealer machines. These technologies enable real-time performance tracking, predictive maintenance, and operational optimization, helping users reduce downtime, improve productivity, and enhance overall equipment efficiency in packaging operations.

-

Focus on Sustainable Packaging Compatibility

L-sealer machines are being designed to handle eco-friendly packaging materials such as recyclable films and biodegradable wraps. This trend supports sustainability goals, helps companies meet regulatory requirements, and aligns packaging operations with growing environmental awareness among consumers and industries.

-

Demand for Flexibility and Customization

Growing product variety and changing packaging formats are driving demand for flexible L-sealer machines. Modern designs support quick changeovers, adjustable sealing parameters, and multiple package sizes, enabling manufacturers to adapt efficiently to evolving customer demands and dynamic market conditions.

What is the Potential Growth Rate of the L-Sealer Machine Industry?

The market growth is driven by increasing automation in packaging operations, rising demand for efficient sealing solutions, and expanding applications across food, pharmaceutical, and consumer goods industries. Advancements in machine reliability, energy efficiency, and flexible packaging compatibility are accelerating adoption. The market is projected to register a steady growth rate in the mid-single-digit range over the forecast period, supported by industrial expansion and modernization trends.

Regional Analysis:

Who is the leader in the L-Sealer Machine Market?

North America dominates the market due to well-established manufacturing and packaging industries, strong adoption of automation technologies, and high demand for efficient, reliable packaging solutions. The region’s focus on quality standards, food safety regulations, and advanced supply chain infrastructure supports sustained investment in modern packaging equipment. Additionally, a robust presence of key industry players and continuous innovation further reinforce North America’s leading position in this market.

U.S. L-Sealer Machine Market Trends

The U.S. leads the North American market due to its advanced manufacturing infrastructure, high automation adoption, and strong packaging demand across food, pharmaceutical, and e-commerce sectors. Strict quality and safety standards drive investment in reliable packaging equipment, while continuous technological innovation and a robust industrial ecosystem further reinforce the country’s dominant position.

How is the Opportunistic is the Rise of the Asia Pacific in the L-Sealer Machine Market?

The Asia-Pacific region is the fastest-growing in the market due to rapid industrialization, expanding packaging and manufacturing sectors, and rising demand from food, pharmaceutical, and e-commerce industries. Increasing automation adoption, growing consumer markets, and investment in modern packaging infrastructure are accelerating equipment uptake. Additionally, improving economic conditions and production capacity expansions across key countries support this strong growth momentum.

China L-Sealer Machine Market Trends

China’s dominance in the Asia-Pacific market is driven by its large-scale manufacturing ecosystem, strong packaging demand across food, pharmaceuticals, and consumer goods, and widespread adoption of automated production lines. Cost-effective manufacturing, high equipment production capacity, rapid industrial upgrades, and extensive domestic and export-oriented packaging operations further strengthen China’s leading position in the regional market.

Latest trends in the China L-sealer machine industry include increasing integration of automation and smart controls, growing compatibility with sustainable and recyclable packaging materials, and demand for high-speed, energy-efficient machines. Manufacturers are focusing on flexible designs, improved sealing precision, and scalability to support expanding e-commerce, food processing, and pharmaceutical packaging applications.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Segment Outlook

Type Insights

What made the Manual Segment Dominant in the L-Sealer Machine Market?

The manual segment dominates the market because it is cost-effective, simple to operate, and suitable for small to medium enterprises with lower production volumes. Its ease of use, minimal maintenance needs, and flexibility for varied packaging tasks make it ideal for food vendors, retail packaging, and businesses without advanced automation. Manual machines also require less training and upfront investment, driving extensive use.

The automatic segment is the fastest-growing in the market because it offers higher throughput, consistent sealing quality, and reduced labor requirements. Its ability to handle large-scale production, integrate with conveyors and packaging lines, and improve operational efficiency makes it ideal for industries like food, pharmaceuticals, and e-commerce. Automation boosts speed, accuracy, and reliability, driving rapid adoption.

Application Insights

How the Food and Beverages Dominated the L-Sealer Machine Market?

The food and beverages segment dominates the market because these machines ensure product freshness, hygiene, and extended shelf life, which are critical for perishable goods. High demand for packaged food, strict safety standards, varied package formats, and the need for efficient, reliable sealing solutions in processing plants and retail outlets drive extensive use. Ease of integration into production lines further supports leadership.

The consumer goods segment is the fastest-growing application in the market because increasing e-commerce, diverse product formats, and demand for attractive, protective packaging drive adoption. L-sealer machines efficiently handle varied sizes, ensure secure seals, and improve presentation. Their flexibility, speed, and ability to enhance durability and shelf appeal make them widely used for consumer goods packaging needs.

End-User Insights

What made the Large Enterprises Segment Dominant in the L-Sealer Machine Market?

The large enterprises segment dominates the market because these companies require high‑volume, reliable, and efficient packaging solutions to support large production scales. With greater capital for automation, advanced equipment integration, and complex packaging lines, large enterprises prioritize consistent quality, speed, and reduced labor costs. Their focus on operational efficiency and compliance with strict industry standards drives extensive use of L‑sealer machines.

The small and medium enterprises segment is the fastest‑growing segment in the market because these businesses are increasingly adopting cost‑effective and easy‑to‑use packaging solutions to support expanding operations. Rising demand for packaged products, growth in local retail and e‑commerce, and the need for flexible, space‑efficient equipment drive widespread uptake of L‑sealer machines among SMEs.

More Insights of Towards Packaging:

- Packaging Films Market Size and Segments Outlook (2026–2035)

- Contract Packaging and Fulfilment Services Market Size, Trends and Regional Analysis (2026–2035)

- Canada Pharmaceutical Packaging Market Size, Trends and Segments (2026–2035)

- South Korea Cosmetic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Germany Flexible Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Cosmetic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Pharmaceutical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- U.S. Glass Packaging Market Size and Segments Outlook (2026–2035)

- Flexible Packaging Adhesive Market Size, Trends and Regional Analysis (2026–2035)

- France Pharmaceutical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Japan Packaging Machinery Market Size, Trends and Competitive Landscape (2026–2035)

- Repackaging Service Market Size and Segments Outlook (2026–2035)

- Corrugated Automotive Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Barrier-Coated Flexible Paper Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Bio-Based Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Active and Intelligent Packaging Market Size and Segments Outlook (2026–2035)

- Plain Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Packaging Waste Management Market Size, Trends and Competitive Landscape (2026–2035)

- Track and Trace Packaging Market Size, Trends and Segments (2026–2035)

- Single-Use Plastic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

Recent Breakthroughs in the L-Sealer Machine Industry

-

In January 2025, PAC Machinery, a packaging technology company, participated in Pack Expo Southeast, highlighting a range of innovative packaging machines and solutions, including automated pouch and bag sealers relevant to L‑sealer technologies. The exhibit emphasized automation, flexible bagging equipment, and productivity enhancements that help manufacturers streamline packaging operations, reflecting broader adoption of advanced sealing and wrapping systems in the packaging sector.

Top Companies in the Global L-Sealer Machine Market & Their Offerings

Tier 1:

- Bosch Packaging Technology (Syntegon): Provides high-speed, automated L-sealers integrated into complex production lines for pharma and food.

- ULMA Packaging: Offers versatile automatic L-sealers capable of handling various film types for diverse production scales.

- ProMach, Inc.: Delivers high-quality, durable L-bar sealers through its Texwrap brand for professional-grade shrink wrapping.

- PAC Machinery: Supplies a wide range of Clamco brand sealers, from compact tabletop units to heavy-duty electric systems.

- Sealed Air Corporation: Focuses on rugged Cryovac L-sealing equipment engineered specifically for high-performance shrink film applications.

- Signode Industrial Group LLC: Provides reliable, automated L-sealing solutions designed for industrial-strength end-of-line packaging and protection.

Tier 2:

- Fuji Machinery Co., Ltd.

- Wexxar Packaging, Inc

- Aetna Group S.p.A.

- Cavanna Packaging Group

- Barry-Wehmiller Companies, Inc.

Segment Covered in the Report

By Type

- Manual

- Tabletop / Bench-top hand-operated

- Foot-pedal manual L-bar

- Hand-trigger / portable manual

- Semi-Automatic

- Semi-automatic L-bar with film unwind

- Semi-automatic with conveyor (single speed)

- Semi-automatic impulse seal

- Semi-automatic constant-heat seal

- Automatic

- Inline automatic L-sealer (low speed)

- High-speed automatic inline L-sealer

- Fully automatic with integrated shrink tunnel

- Robot-assisted automatic L-sealer

- Automatic with infeed/outfeed conveyors & sorting

By Application

- Food & Beverage

- Bakery (loaves, pastries)

- Meat & Poultry

- Ready-to-eat / convenience foods

- Beverages (bottles, multipacks)

- Dairy & cheese

- Frozen foods

- Pharmaceuticals

- Blister card & packet secondary packaging

- Medical devices

- Over-the-counter medicines / kits

- Sterile / clean-room compatible packaging

- Consumer Goods

- Personal care (soaps, cosmetics)

- HouseholdConsumables (detergents, sponges)

- Toys & stationery

- Small appliances

- Electronics

- Small electronics (chargers, headphones)

- Accessories (cables, adapters)

- Electrostatic-sensitive packaging variants

- E-commerce / Retail Multipacks

- Subscription / kit packs

- Promotional multipacks

- Industrial / Hardware

- Tools, fasteners, spares

- Others

- Agricultural produce

- Automotive spare parts

- Custom / specialty items

By End-User

- Small & Medium Enterprises (SMEs)

- Micro manufacturers / home businesses

- Local food producers

- E-commerce sellers (small scale)

- Repair/after-sales: in-house vs outsourced

- Large Enterprises

- Multinationals / contract packagers

- Co-packers & third-party logistics (3PL) packaging lines

- High-volume food & pharma manufacturers

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

-

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5954

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

- Unbleached Kraft Paperboard Market Size, Trends and Segments (2026–2035)

- Egg Boxes and Trays Market Size and Segments Outlook (2026–2035)

- Corrugated Packaging for Pharmaceutical Market Size, Trends and Competitive Landscape (2026–2035)

- Germany E-Commerce Packaging Market Size and Segments Outlook (2026–2035)

- Corrugated Box Packaging for Electronics Market Size, Trends and Regional Analysis (2026–2035)

- Reusable Cold Chain Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Polypropylene Corrugated Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- North America Packaging Tape Printing Market Size and Segments Outlook (2026–2035)

- Europe Fresh Food Packaging Market Size and Segments Outlook (2026–2035)

- Packaging Tape Printing Market Size and Segments Outlook (2026–2035)

- Unit Dose Packaging Market Size, Trends and Regional Analysis (2026–2035)

- North America High-Barrier Packaging Films Market Size, Trends and Segments (2026–2035)

- Corrugated Boxes for Transit Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Carbonated Soft Drinks (CSD) Packaging Market Size, Trends and Segments (2026–2035)

- Personalized Packaging Market Size, Trends and Segments (2026–2035)

- Protein Packaging Market Size, Trends and Regional Analysis (2026–2035)

- PP Rigid Plastic Packaging Market Size, Trends and Segments (2026–2035)

- Alcoholic Beverage Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Form-Fill-Seal Packaging Market Size, Segments Data, and Regional Insights (NA, EU, APAC, LA, MEA)

- U.S. Clinical Trial Packaging Market Size, Trends and Regional Analysis (2026–2035)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.